Concora Credit

Concora Credit: Your Pocket-Sized Financial Solution?

Concora Credit: Your Pocket-Sized Financial Solution?

Have you ever found yourself in a bind, needing a quick financial solution right from your smartphone? Well, let me introduce you to Concora Credit, an app that might just become your go-to for handling personal finances seamlessly. As someone who frequently juggles between different financial needs, I decided to dive into this app and see what all the buzz was about. Here’s what I found out.

First Impressions and Getting Set Up

When I first launched Concora Credit, I was impressed by its clean and intuitive interface. It seemed like the developers really focused on making the user experience as straightforward as possible. From the get-go, I was prompted to create an account—a process that was surprisingly quick. All it took was entering some basic information, and voilà, I was ready to explore the app's features.

Handy Tools You'll Actually Use

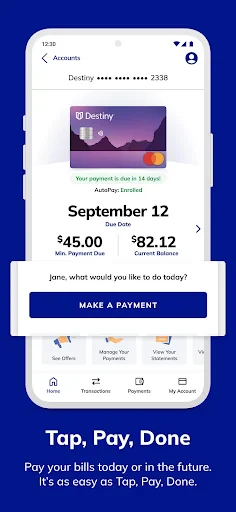

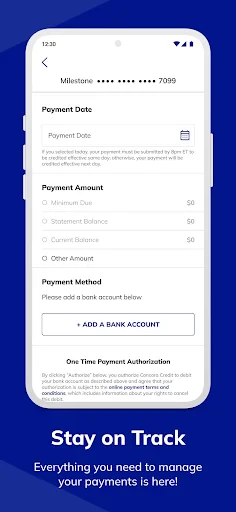

One of the most compelling aspects of Concora Credit is its ability to offer instant credit access. Imagine needing some quick cash and having it available at your fingertips without jumping through hoops. That’s the convenience this app promises. The credit check is swift, and the entire process is designed to be hassle-free. Instant access to credit is definitely a game-changer for many users.

Another feature that caught my eye was the budgeting tool. I’m not the best at keeping track of expenses, so having an app that allows me to categorize and monitor my spending habits is a huge plus. The app sends timely reminders about upcoming bills and offers insights into my spending patterns, helping me make informed financial decisions.

Can You Trust It With Your Money?

Now, let’s talk about something that’s on everyone’s mind when dealing with financial apps—security. Concora Credit assures users that their data is protected with top-notch encryption technology. As someone who is cautious about online security, I appreciated the multiple layers of protection the app provides, including biometric login options. It’s always reassuring to know that your financial data is safeguarded against potential threats.

The Final Verdict After Using It

After using Concora Credit for a while, I can say that it has become a handy tool in my financial arsenal. Whether it’s accessing quick credit or managing my monthly budget, this app has simplified many aspects of my financial life. The user interface is friendly, the features are practical, and the app runs smoothly without any hiccups.

Would I recommend it? Absolutely. If you’re someone who values convenience and efficiency in managing personal finances, then Concora Credit is worth checking out. It’s like having a mini financial advisor right in your pocket, ready to assist whenever you need it.

- Developer

- Concora Credit

- Version

- 2.0.11

- Installs

- 500,000+

- Android Version

- 5.0

- Content Rating

- Everyone

- Price

- Free

- User-friendly interface enhances navigation.

- Offers real-time credit score updates.

- Comprehensive financial insights available.

- Custom alerts for credit changes.

- Secure encryption ensures data safety.

- Limited customer support availability.

- Some features require premium access.

- Occasional app crashes reported.

- Slow loading times on older devices.

- Limited integration with other financial apps.