Drive Safe & Save®

Revving Up with Drive Safe & Save®

Revving Up with Drive Safe & Save®

Ever wondered if your driving habits could actually save you money? Well, buckle up because Drive Safe & Save® by State Farm is here to revolutionize the way we think about car insurance! I've taken this app for a spin, and here’s the lowdown from my experience.

Getting the App Ready to Go

First things first, getting the app up and running is a breeze. Available on both Android and iOS, the download is quick and painless. Once installed, you’re greeted with a clean, intuitive interface that guides you through the setup process. You’ll need to link the app to your State Farm account and pair it with a Bluetooth beacon that stays in your car.

What’s cool here is that the app is designed to track your driving habits. And trust me, it does this seamlessly! The beacon connects automatically every time you start your car, recording data that the app uses to assess your driving.

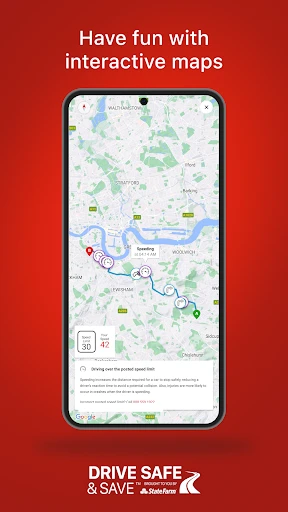

A Look at the App in Action

Every drive is an opportunity to save, and this app makes you aware of that fact every time you hit the road. It tracks key metrics like speed, acceleration, braking, and even the time of day you’re driving. If you’re a night owl, you might want to rethink those late-night spins, as driving at night can affect your score.

One of my favorite features is the trip summary. After each drive, the app provides a detailed breakdown of your performance. It’s like having a coach in your pocket, nudging you to improve. Plus, seeing those potential savings grow with each careful drive is pretty motivating!

The Real Benefits: Safety and Cash Back

Let’s talk about the big question: How does this app save you money? Essentially, the safer you drive, the more you save on your auto insurance. The app calculates a discount based on your driving habits, which can lead to substantial savings over time. I found this aspect particularly rewarding – who wouldn’t want to save some cash just by being a cautious driver?

Beyond the financial benefits, there’s also the added bonus of becoming a more mindful driver. The constant feedback loop encourages you to adopt safer driving habits, which not only benefits your wallet but also contributes to overall road safety.

Overall Impressions and Final Thoughts

After spending some quality time with Drive Safe & Save®, I can confidently say it’s a win-win for any driver looking to save on insurance while improving their driving habits. The easy setup, insightful feedback, and potential for savings make it a no-brainer for State Farm customers.

So, if you’re ready to embark on a journey of safer driving and savings, this app deserves a spot on your phone. Just remember, good driving isn’t just about saving money – it’s about keeping yourself and others safe on the road. Happy driving!

- Developer

- State Farm Insurance

- Version

- 4.5.3

- Installs

- 5,000,000+

- Android Version

- 9

- Content Rating

- Everyone

- Price

- Free

- Monitors driving habits for discounts.

- Compatible with most smartphones.

- Integrates with State Farm policies.

- User-friendly interface.

- Real-time feedback on driving.

- Requires State Farm insurance.

- Uses smartphone battery and data.

- May have privacy concerns.

- Not available in all states.

- Potential technical glitches.