Kikoff - Build Credit Quickly

Kikoff - Build Credit Quickly

Kikoff - Build Credit Quickly

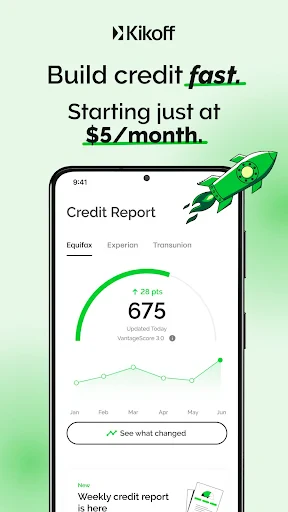

So, I recently stumbled upon this pretty cool app called Kikoff - Build Credit Quickly. I know, building credit isn’t exactly the most thrilling topic, but trust me, this app makes it as painless as possible. If you’re like me and you've been trying to figure out a way to get that credit score up without diving into a pile of complicated financial books, then grab a cup of coffee and let’s dive into Kikoff.

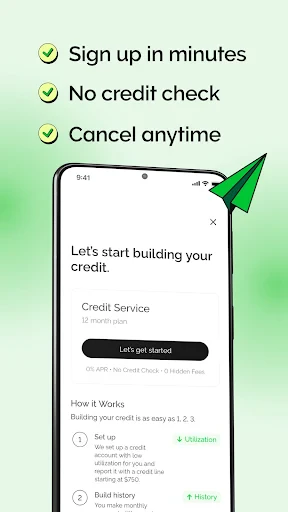

First things first, setting up Kikoff is a breeze. You download the app, sign up with your details, and boom, you’re in. What I love about Kikoff is that it doesn’t require any credit checks to get started. So, if you’re starting from scratch or trying to rebuild after a few financial hiccups, breathing a sigh of relief is totally justified.

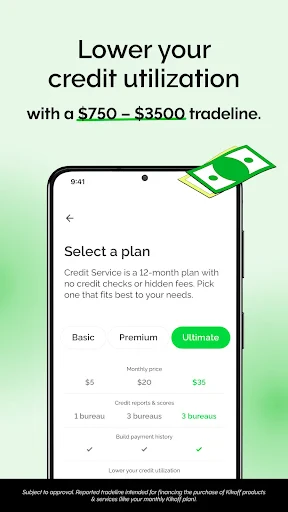

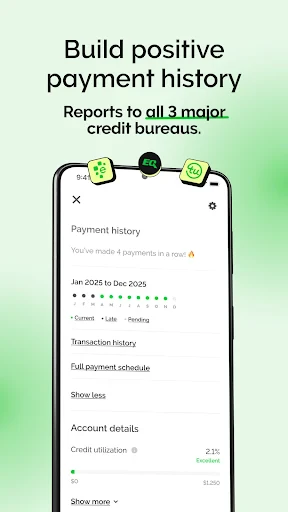

Okay, let’s break it down. The main idea behind Kikoff is that it gives you a credit line that you can use to purchase products from their store. Now, I know what you’re thinking, "An online store? Really?" But hear me out. The purchases are small, think ebooks or small gadgets, and the kicker is that your payments (which are super manageable, by the way) are reported to the credit bureaus. This means that as you pay off your items, your credit score gets a little boost.

The user interface is clean and intuitive, which is always a win in my book. Navigating through the app is straightforward, and all the information you need is right there at your fingertips. I didn’t find myself scratching my head trying to figure out how things work, which is a huge plus.

Moreover, Kikoff doesn’t charge any fees. Yep, you heard that right—no hidden fees, no annual fees, nada. It’s like a breath of fresh air in a world where we’re so used to getting hit with unexpected charges.

So, who should be jumping on the Kikoff bandwagon? If you’re someone who’s new to credit or trying to rebuild, Kikoff is definitely worth considering. It’s low-risk, and the fact that there are no fees involved makes it even more appealing. However, if you’re looking for a traditional credit card experience with bells and whistles, you might find Kikoff a bit too simplistic.

In my opinion, Kikoff is like that trusty starter bike with training wheels. It’s perfect for getting you started on the path to building a solid credit foundation without the fear of falling flat on your face.

Overall, Kikoff - Build Credit Quickly is an innovative approach to tackling the sometimes daunting world of credit scores. It’s simple, effective, and most importantly, it’s user-friendly. While it might not be the ultimate solution for everyone, it’s undoubtedly a fantastic stepping stone for those looking to take control of their financial future.

So, if you’re ready to give your credit score a little nudge in the right direction, Kikoff might just be the app for you. And who knows, maybe one day you’ll look back and wonder how you ever managed without it

- Developer

- Kikoff, Inc.

- Version

- 1.120.1609

- Installs

- 1,000,000+

- Android Version

- 7.0

- Content Rating

- Everyone

- Price

- Free

- User-friendly interface for all ages.

- Quick setup with minimal requirements.

- Free credit score tracking available.

- Personalized financial tips included.

- Secure data encryption ensures privacy.

- Limited credit building options.

- Requires bank account for verification.

- No mobile app notifications.

- Customer support only via email.

- No live chat support option.