OnePay – Mobile Banking

Welcome to the Future of Banking

Welcome to the Future of Banking

Hey there! If you're anything like me, you've probably had your fill of traditional banking. Long queues, endless paperwork, and the dreaded "banking hours" that never really fit into our schedules. Enter One – Mobile Banking, a revolutionary app that's here to shake up the way we handle our finances. Trust me, after giving this app a spin, you'll wonder how you ever lived without it.

Getting Started is Super Simple

Right from the start, One makes a great first impression with its clean and easy-to-use design. Signing up is a total snap. With just a few taps on your phone, you're in and ready to go. The app even gives you a virtual walkthrough to show you all its features. It’s like having your own personal banker, but you can skip the awkward chit-chat.

Handy Tools That Make Life Easier

This is where the app really stands out. From budgeting help to saving strategies, it's like carrying a financial planner in your pocket. The budgeting feature is really clever – it automatically sorts your spending, so you can see exactly where your money is going. And the best bit? It sends you gentle nudges to help you stay on budget, so you can avoid any end-of-month shocks.

Saving money is a piece of cake, too. You can create your own personalized savings goals and watch your balance grow. Whether you're saving for a new phone, a holiday, or just a safety net, One has you covered. They also offer some pretty good interest rates, which is always a nice perk.

Peace of Mind with Top-Tier Security

I get it, safety is a big question. The short answer is, absolutely. One uses the latest and greatest security tech to make sure your money and information are always safe. With things like fingerprint login and heavy-duty data encryption, they've thought of everything. It’s like having a high-tech vault for your cash.

Manage Your Money From Anywhere

A huge plus for One is that it's built for your phone. Need to send money, pay a bill, or just see your balance? It’s all right there at your fingertips. And because it's available all day, every day, you can handle your banking whenever it suits you. It’s ideal for anyone with a busy lifestyle who needs their bank to be just as flexible.

A Helpful Team Has Your Back

If you ever run into a problem, One’s support team is there to save the day. You can reach them by chat, email, or phone, and they're always happy to help with a positive attitude. It’s really comforting to know that a real person is just a message or call away if you need assistance.

Wrapping It Up

So, to sum it all up, One – Mobile Banking is a real winner. It brings together ease of use, strong security, and a full set of tools to make handling your money straightforward. No matter your experience with finance, this app is definitely worth checking out. So, what are you waiting for? Give it a go. Your future self will be glad you did.

- Developer

- ONE Finance, Inc.

- Version

- 5.7.0

- Installs

- 1,000,000+

- Android Version

- 7.1

- Content Rating

- Everyone

- Price

- Free

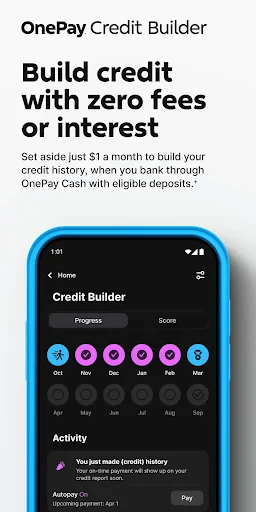

- No monthly fees or minimum balance requirements.

- Instant notifications for all transactions.

- User-friendly interface with sleek design.

- Secure login with biometric authentication.

- Wide range of financial tools and insights.

- Limited to U.S. residents only.

- No physical branches available.

- Customer service lacks 24/7 support.

- Some features require premium upgrade.

- Occasional app performance lags.