Dave - Fast Cash & Banking

Dave - Fast Cash & Banking

Dave - Fast Cash & Banking

What's All the Hype?

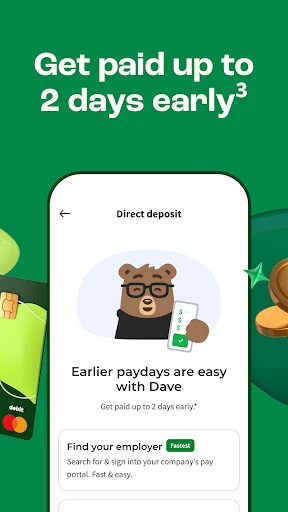

So, let's break it down. Dave isn't just another app for your money. Think of it as a financial friend who's there for you when things get a little tight. The main goal is to help you dodge those annoying overdraft charges by spotting you a small loan from your next paycheck. That's right—no more stressful moments when your card gets declined.

Getting Started

Setting up your Dave account is a breeze. All you need to do is download the app, create your profile, and connect your main bank account. The whole sign-up process is really simple, and I was impressed with how fast it went. On top of that, the app's design is clean and straightforward, which is something I always appreciate.

Handy Tools at Your Fingertips

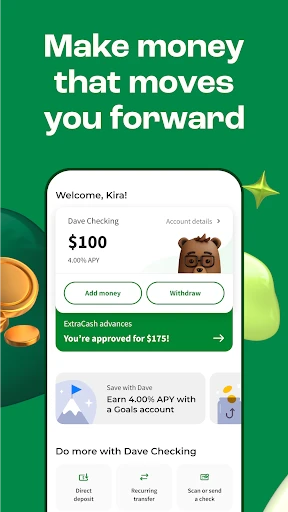

A feature that really stands out is the built-in budget helper. It's like having a tiny money coach right in your phone. The app looks at how you spend and then helps you set up a budget that's actually doable. And if you're not great at saving, Dave has a trick for that, too. It can automatically set aside small amounts of cash for you.

But that's not all! Dave also includes a side job finder. You can browse for small gigs directly in the app, which is awesome if you need to earn a little extra money. It's basically a pocket-sized job market.

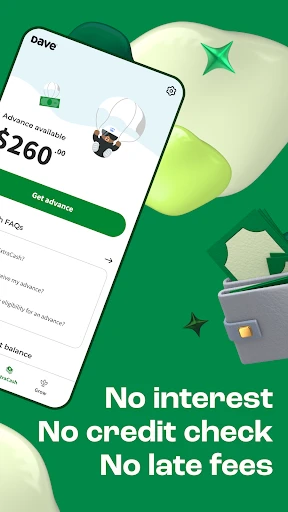

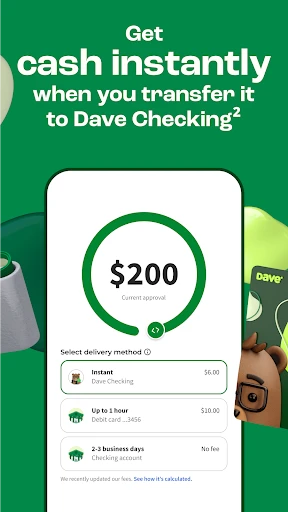

Getting a Cash Advance Made Simple

Now, let's talk about the cash advance, which is likely the main reason you'd get the app. Dave lets you borrow a small amount to get you through to your next payday. The best part? There are no sneaky fees or high interest rates. You simply leave a tip that you feel is fair, which is a nice change from scary payday loans.

My Personal Take

So, what's my final verdict on Dave? In all honesty, it's a real help when you're in a financial bind. The app is easy to use, comes with a bunch of great features, and, most importantly, it helps you build better money management skills. It's not only about quick cash; it's about creating healthier financial habits.

Of course, no app is perfect. The cash advance feature is helpful, but the amounts are on the smaller side, so it might not cover bigger emergencies. Also, while the tipping model is fair, those tips can become a cost if you use the service a lot.

To wrap it up, if you want a finance app that does more than just the basics, Dave is absolutely worth a look. It combines cash advances with budgeting help, making it a solid all-in-one option for anyone wanting to take more control of their cash.

- Developer

- Dave Operating LLC

- Version

- 3.73.0

- Installs

- 10,000,000+

- Android Version

- 9

- Content Rating

- Everyone

- Price

- Free

- Instant cash advances available

- No hidden fees or interest charges

- User-friendly interface

- Automated budgeting features

- No credit check required

- Limited to small cash advances

- Requires access to bank account

- Not available in all regions

- Monthly membership fee

- Limited financial products offered